FXIFY Trade of the Month: July Recap

July at FXIFY: tech rallies, gold ranges, dollar rebounds. Top traders banked big — see Juan’s $43K S&P short in 66 seconds.

July kept traders honest. Tech ripped, gold cooled into a range, and the dollar staged a late-month comeback that forced FX desks to adapt on the fly. Ready to parse what mattered and where the edge was?

Welcome back to the FXIFY™ Monthly Recap — July kept the momentum alive. Tech-led risk appetite put U.S. indices in play and rewarded clean breakout tactics, while our desk leaned into high-quality continuation setups on the majors.

By month-end, the dollar firmed, turning EUR and GBP two-way and reminding traders to bank on strength rather than overstay breakouts. It wasn’t a runaway trend, but the tone shift mattered for timing and risk.

Meanwhile, XAUUSD spent most of the month rotating in a tight pocket — prime territory for disciplined range work. That tracks with our trading data too: gold topped community volumes, with EURUSD and NAS100 close behind.

Top 5 Payouts of the Month

This time, our top 5 is a healthy mix of several account types, with two top earners being FXIFY™ Instant Funding account holders — a welcome addition!

It’s a powerful reminder that our community is of a diverse cast of traders; as different account structures can suit different trading styles. And choosing the right one can help you work towards your trading goals with confidence, in a big way.

| Rank | Trader | Account Size | Payout Amount | Biggest Win |

|---|---|---|---|---|

| 1 | Adil K | $200K – One Phase | $11,700.00 | $3,018.00 |

| 2 | Kiran T | $200K – Two Phase | $11,571.42 | $4,140.00 |

| 3 | Dookee N | $50K – Instant Funding | $10,545.76 | $2,493.00 |

| 4 | Evan G | $400K – Two Phase | $9,585.34 | $5,599.44 |

| 5 | Paula G | $50K – Instant Funding | $7,291.37 | $8,222.84 |

Trade of the Month: Juan’s $43,400 Short on S&P 500

Fast, clean, and clinical — Juan V. captured $43,400 in 66 seconds shorting US500 (CFD ticker for S&P 500) on July 23, 2025!

This trade occurred on a day when U.S. indices were pressing record highs on trade-deal optimism, but instead of following the herd, Juan observed the price action on the 1-minute timeframe and spotted a reversal opportunity.

Juan entered a short at $6,331.12 and exited at $6,326.78. This was an elite counter-momentum play: spot the exhaustion, bank the pullback (quickly), and step aside.

| $43,400GAIN REALISED | US500PAIR TRADED | 0:01:06HOLDING TIME |

|---|

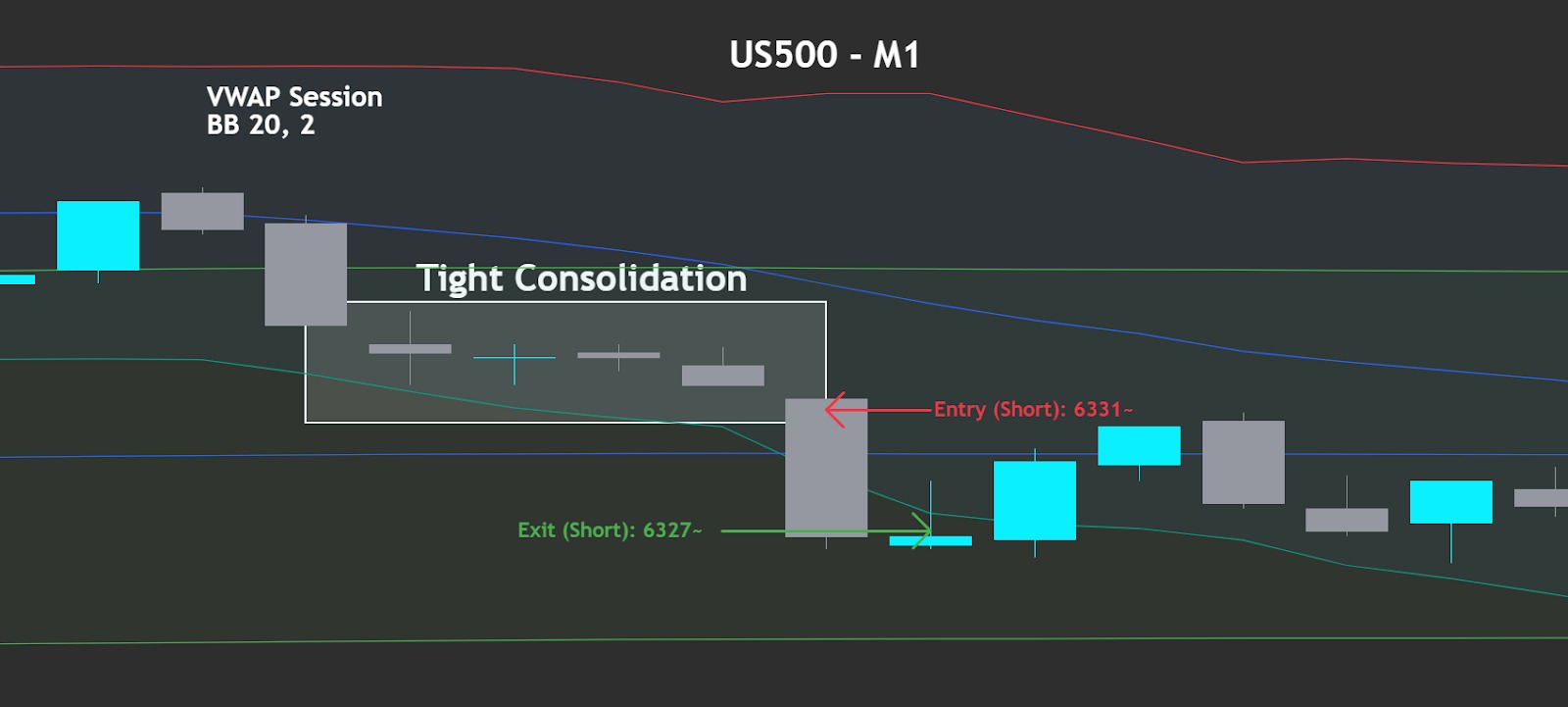

The Setup: Acceptance Below VWAP + Base Breakdown

Price built a short M1 support shelf near $6,331 while VWAP trended above and below. The 16:45 candle broke and closed below the shelf, staying below the VWAP, and opened a room toward $6,326–$6,327, which aligned with the first lower Bollinger Band tag.

The Entry: Confirmation, Not Prediction

Short on the decisive break of $6,331 (or a quick retest-and-fail of that level underneath VWAP). That’s a rules-based scalp: trade acceptance below VWAP, don’t guess the high.

The Exit: Pay the First Impulse

Cover into the $6,326–$6,327 pocket at $6,326.78, about 66 seconds later on the first pause/lower-band touch. Bank the impulse; don’t overstay while the higher-timeframe trend is up.

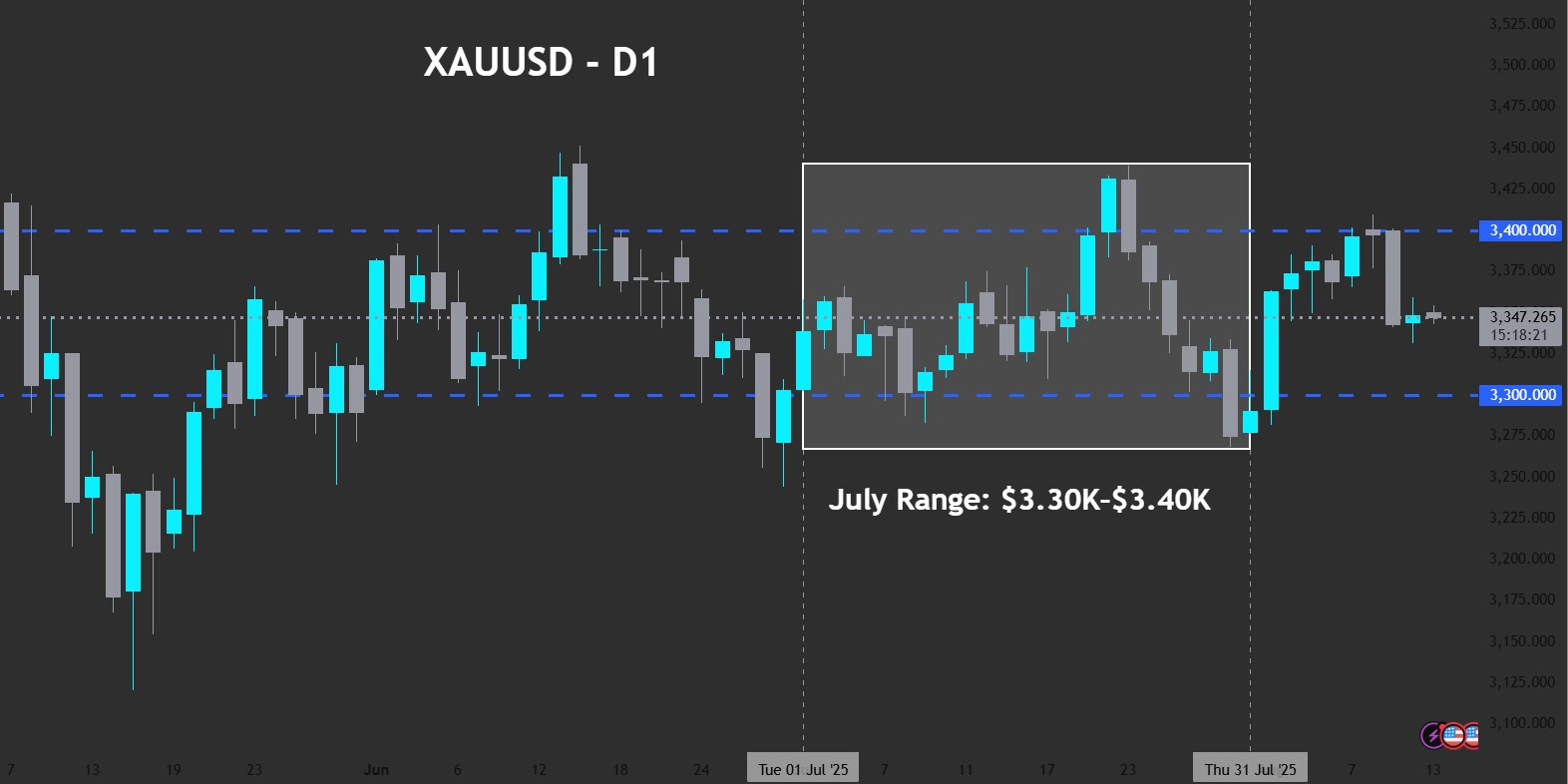

Move of the Month: Gold Stayed Tradeable in a Tight Pocket

| Start Date | July 1, 2025 |

|---|---|

| End Date | July 31, 2025 |

| Starting Price | $3,311.97 |

| Ending Price | $3,285.65 |

| Point Change | -26.32 |

| Percentage Change | -0.79% |

Prices are daily closes from GoldPrice.org: Jul 1, 2025 and Jul 31, 2025.

Top Traded Assets of July

Our community stayed focused on XAUUSD, EURUSD, and NAS100.

| Symbol | Total Trade Volume (USD) | % Price Change M/M |

|---|---|---|

| XAUUSD | $44,191,937,366 | -0.40% |

| EURUSD | $11,289,687,916 | -2.54% |

| NAS100 | $6,218,639,122 | 2.37% |

🥇 XAUUSD (Gold)

Gold popped to five-week highs around Jul 21–22 as the dollar and Treasury yields eased. It then slipped into month-end on trade-deal progress and a steady-rates Fed.

💶 EURUSD

The dollar logged its first monthly gain of 2025 in July, pressuring EUR/USD late in the month. The euro fell sharply around Jul 28–29 as optimism over a U.S.–EU trade pact boosted the greenback.

📈 NAS100 (Nasdaq 100)

Tech leadership held: the Nasdaq posted multiple record closes in mid-July and finished the month up ~2.37%. Momentum breakouts stayed plentiful through the second half.

The Next Top Trader Could Be You!

Seeing July’s results is energising, and it all starts with a single step. Every top trader — including this month’s standouts like Adil K. and Paula G. — began with a challenge and a clear plan.

One of July’s earners did it on Instant Funding, proving you don’t need the biggest account size if the account type fits your style.

| Account Type | $50K Instant Funding (MT5 • RAW) |

|---|---|

| Top Asset | EURJPY |

| Lot Size | 11.25 |

| Biggest Win | $8,222.84 |

| Trading Time | Intraday |

The opportunity is waiting. With FXIFY, you get access to the capital, tools, and flexibility you need to perform at your best. All that’s missing is you.