How to Use AI to Improve Your Trading

AI won’t replace your trading — but it can upgrade you. From journaling to macro research, here’s how smart traders use AI to sharpen their edge.

AI is transforming nearly every industry — from medicine to filmmaking — by giving individuals the power to access insights, automate tasks, and make better decisions. But what about trading?

In this article, we explored and tested how AI tools, specifically ChatGPT 4.0, can support real traders. From chart analysis to performance reviews, we experimented with practical applications to see where AI truly adds value.

The takeaway? AI won’t trade for you, but it can absolutely help you trade better. Let’s break down how.

AI Can Help Your Trading, But Not in the Way You Think

AI isn’t here to trade for you — but it can still play a valuable role. While it can assist with basic technical analysis, its real strength lies in helping traders reflect, organise, and make better-informed decisions. Here’s how it supports the broader trading process:

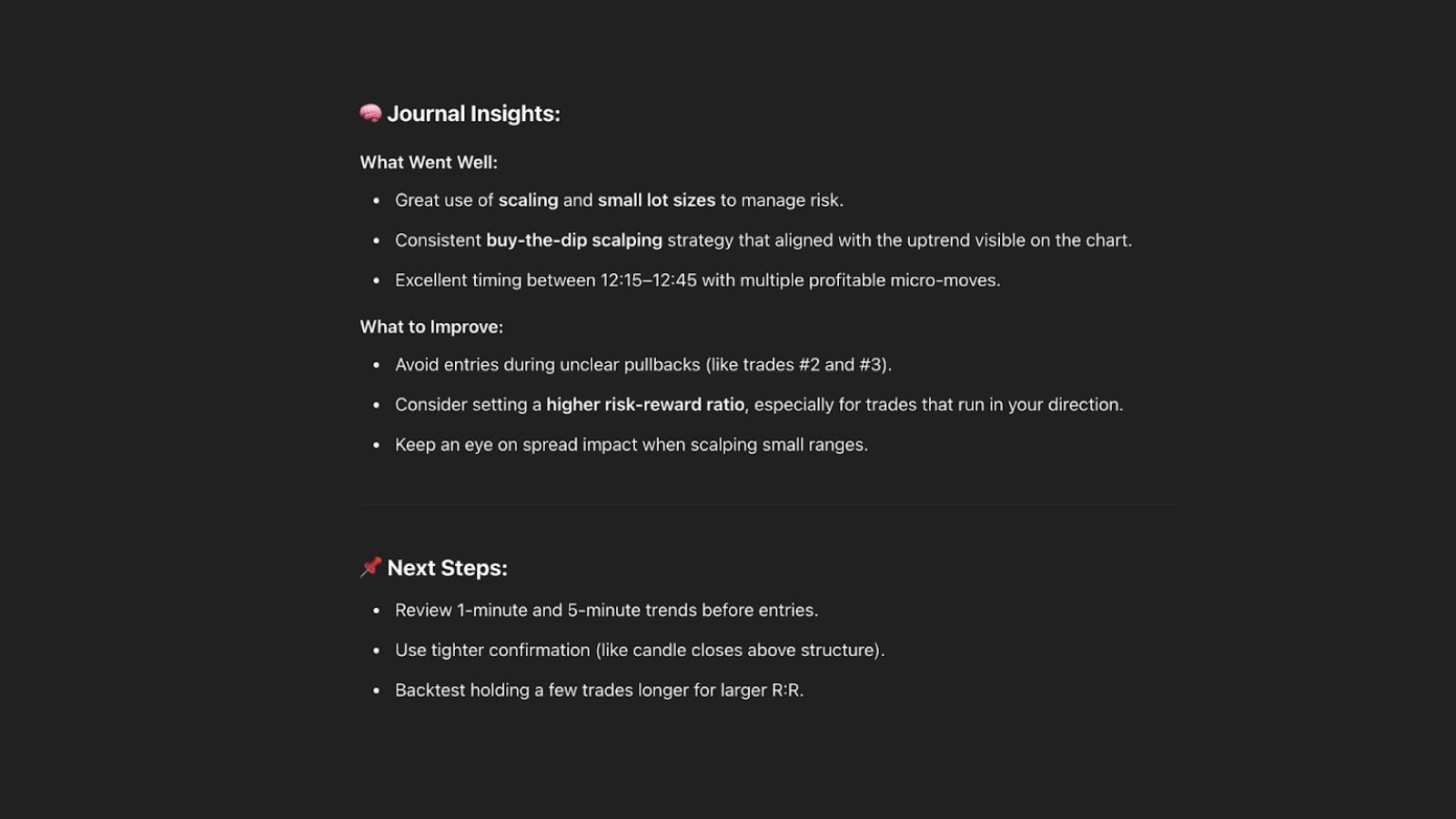

Review Your Performance Data

AI can go through your trading data and help you identify high-performing days, strengths and weaknesses in your trading. By analysing metrics across time — whether it’s your personal trading journal, or a report generated by your trading platform — AI can help spot patterns you might miss.

For example, you could be experiencing consistent losses after news events, or perform stronger during specific sessions. These little insights can make the difference between having a healthy equity curve, or a choppy one.

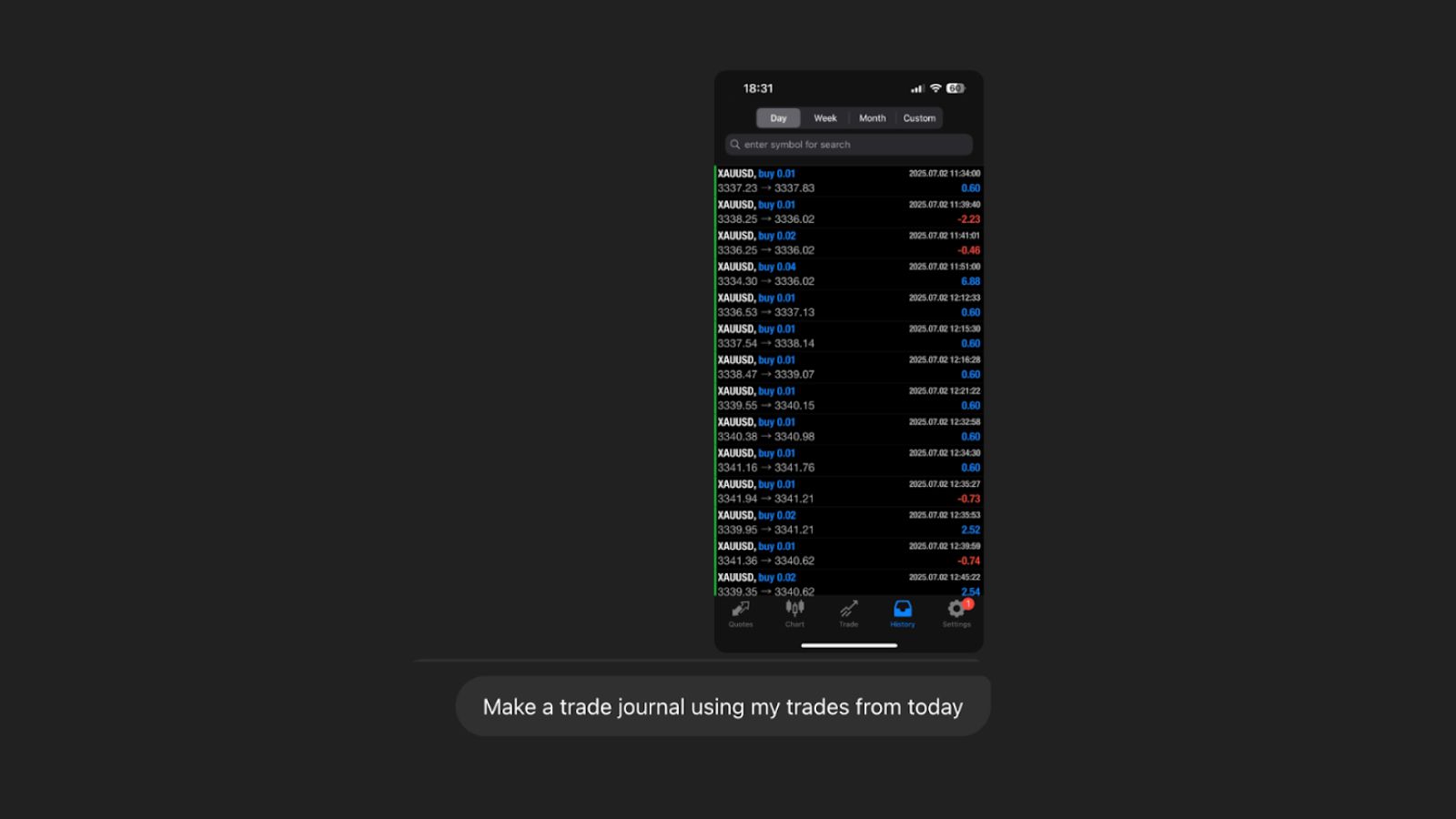

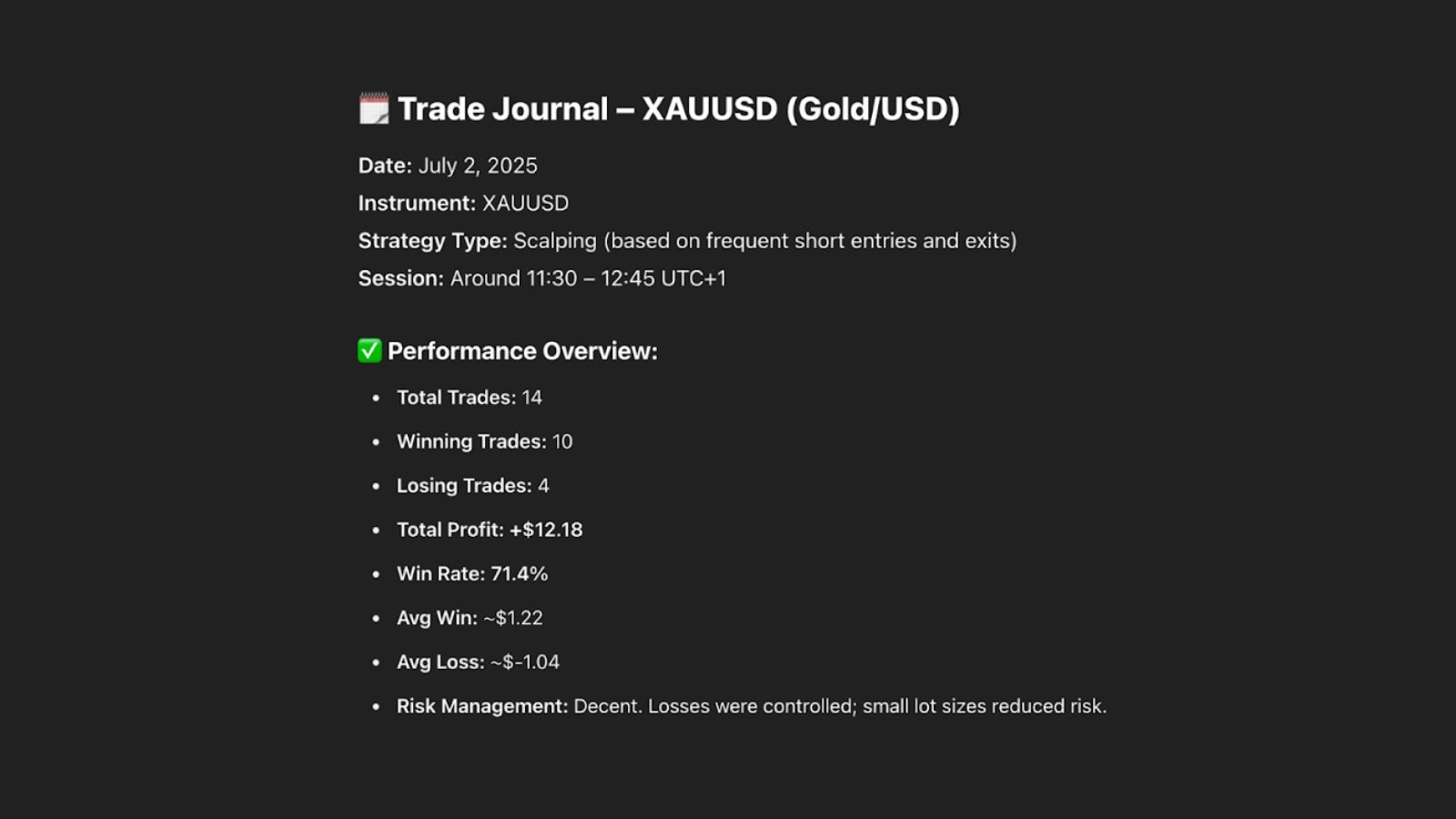

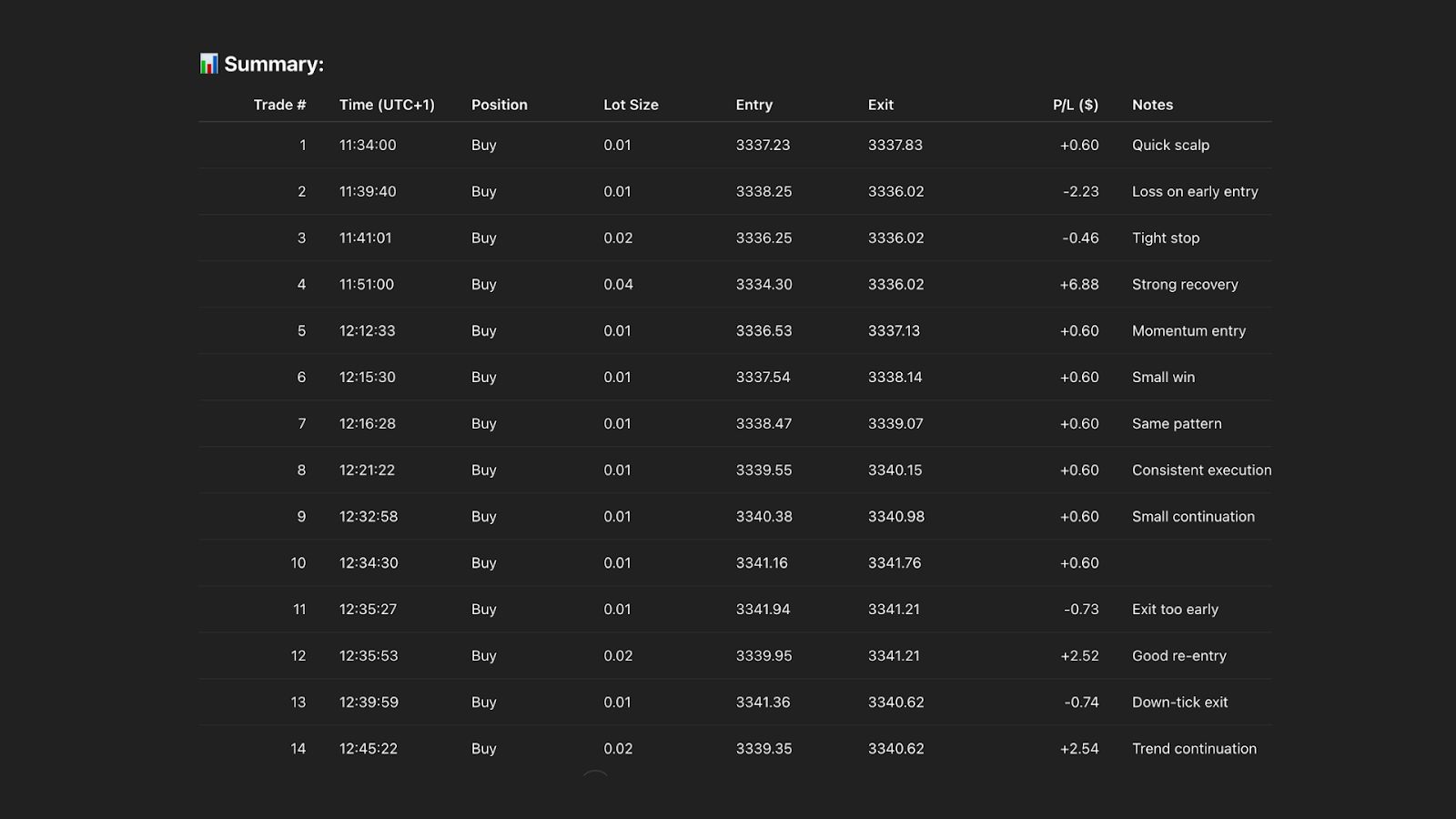

Help You with Journaling

Manual journaling can feel like a chore — but AI can make it significantly faster and more insightful. Instead of spending time categorising your trades and writing lengthy notes, you can feed AI your raw logs or bullet-point summaries. It can then:

- Organise your entries by outcome, setup, or session

- Highlight recurring behaviours or emotional patterns

- Prompt follow-up questions to help you reflect more effectively

This streamlines your journaling workflow and turns it into a tool you’ll actually want to use consistently.

Be Your Psychology Mentor

AI can support your trading psychology by helping you reflect on mental habits and emotional patterns. You can ask it questions like:

“Why do I hesitate to enter after a loss?”

“How can I stay confident after missing a move?”

“Why do I break my rules when I’m in drawdown?”

By describing your recent trading struggles, AI can offer perspective, pattern recognition, and actionable suggestions. It’s not a therapist — but it can help you think more clearly and ask better questions. Teaching it your trading style makes its feedback more relevant and aligned with your decision-making process.

Using AI for Research and Education

AI doesn’t just help with charts and journaling — it can also drastically improve how quickly and clearly you understand the macro environment. From interest rates to wars, AI can act as your personal research analyst, helping you keep up with global developments and learn faster.

Research Fundamentals Faster

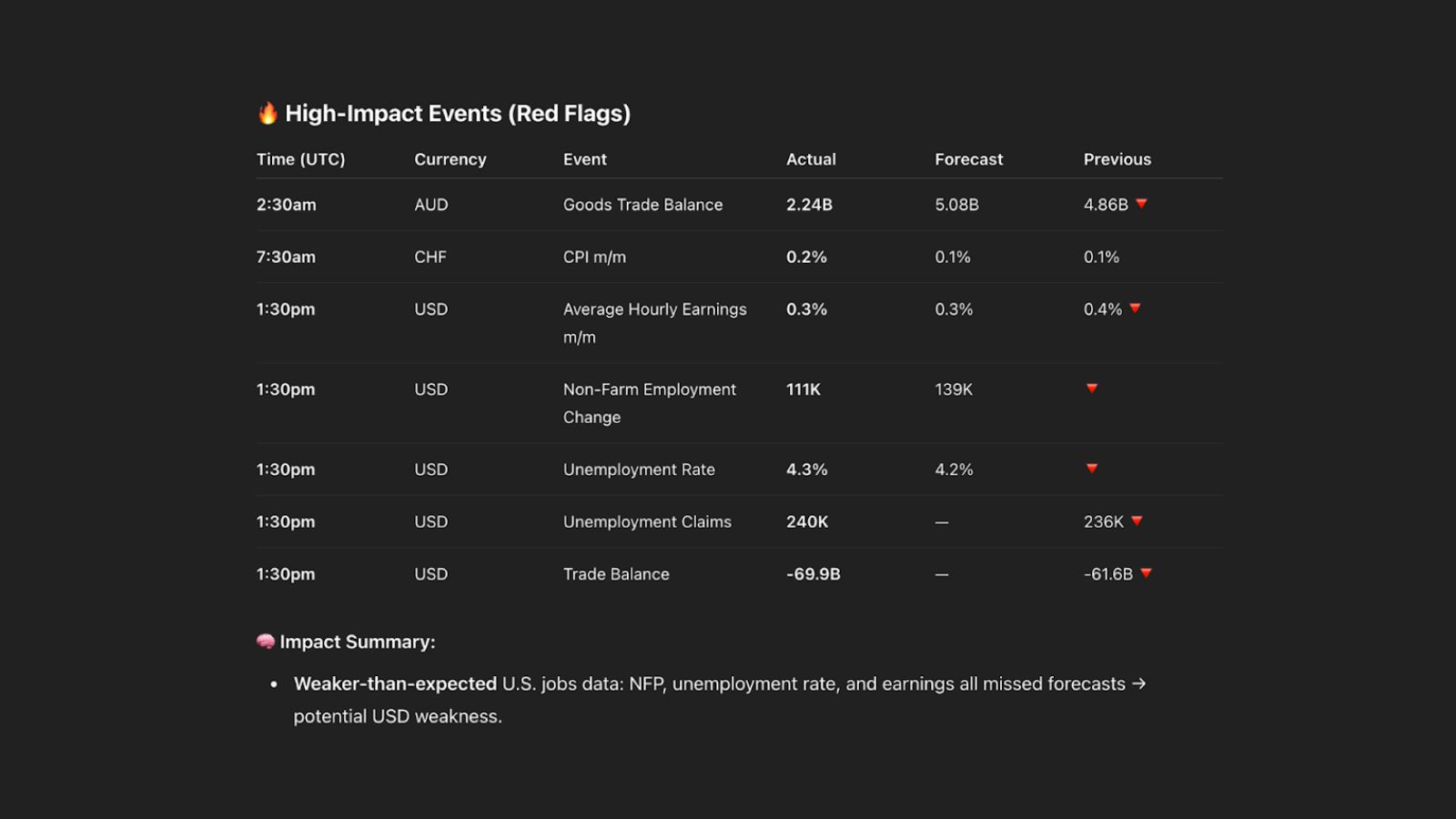

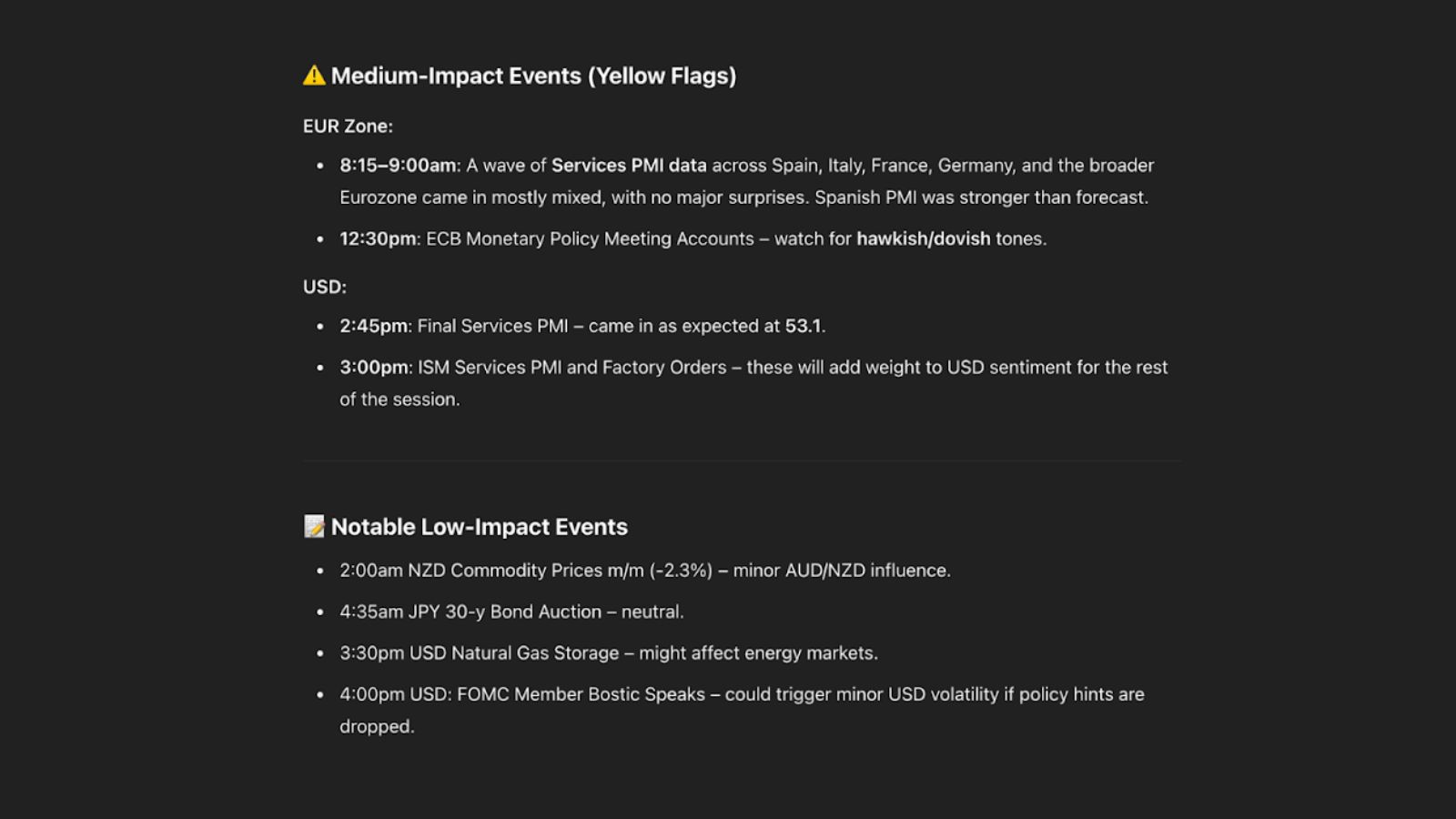

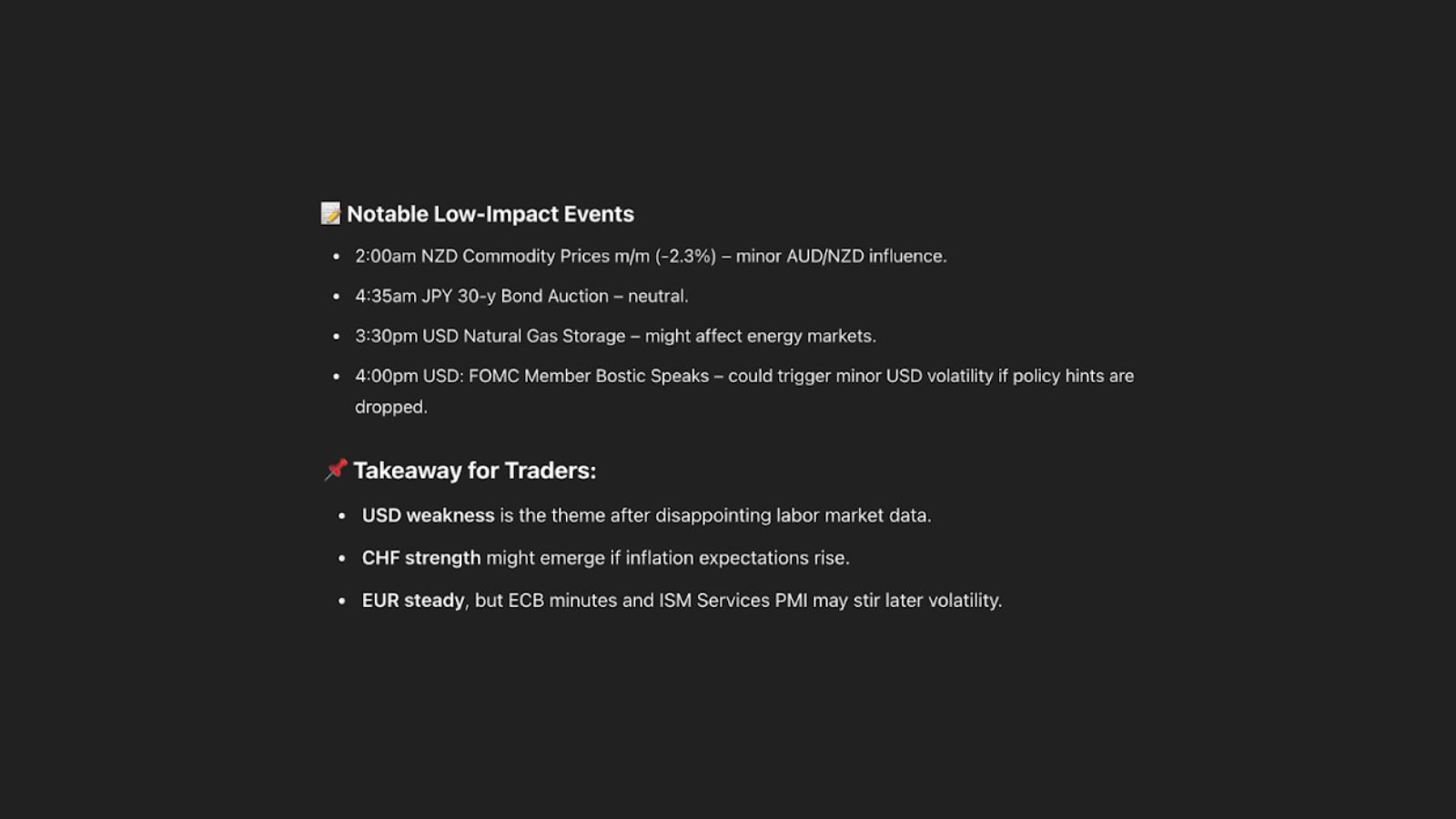

AI can help traders scan and interpret key macroeconomic events — from interest rate decisions to inflation prints — by pulling data from multiple trusted sources and summarising what matters. Rather than manually piecing together this information from different websites, you can ask AI questions like, “What are the key market-moving events this week for GBPUSD?”

Track Geopolitical News That Moves Markets

While most calendars focus on scheduled economic data, AI can help you track developing stories — like tariffs, wars, sanctions, or supply chain disruptions — that impact market sentiment. By aggregating news from multiple outlets, it highlights themes that may otherwise go unnoticed, giving you a broader context for price movement.

Learn Faster and Ask Smarter Questions

One of AI’s biggest advantages is its ability to explain complex topics in plain English. Whether you’re trying to understand how interest rate differentials affect currency pairs or what rising bond yields mean for the USD, AI can break it down in simple terms — and even tailor the answer based on your level of experience.

Some suggestions that come to mind:

| Use Case | How It Helps |

| Summarise a YouTube video | After extracting the transcript, AI can summarise the key points — perfect for learning macro events or trading concepts fast |

| Get answers about a tool | Ask AI how to use an indicator or platform feature, this will be like attending a mini-course or reading an FAQ |

| Simplify economic concepts | Breaks down complex macro ideas into trader-friendly language you can use immediately |

The Result? Better-informed trades, faster research, and a more confident decision-making process.

So, using AI for Technical Analysis — Valid, or Bogus?

Here’s where it gets interesting. Can AI read charts? The short answer is yes, the long answer is a bit more complicated.

Let’s dive into what we found in our research.

Analysing Raw Charts with AI

We first tried uploading a black chart screenshot and asked ChatGPT to analyse it. The results were underwhelming. Without context or clear indicator values, AI struggled to interpret the price action or offer meaningful insights. This confirmed that AI simply couldn’t interpret the chart without context or clear data points — it needs structure to work effectively.

Analysis Strategies & Indicators

When we gave the AI a defined trading strategy and added indicators to the chart, the quality of the analysis improved. It became better at identifying whether entry conditions were met — particularly when rules were clear and visual cues were present.

Adding indicators like RSI, moving averages, or trendlines helped the AI focus on its interpretation. The responses became more aligned with how a human might evaluate a setup. That said, the inconsistency issue remained: even with the same chart and rules, AI didn’t always interpret things the same way twice.

This reinforces that while AI can support technical analysis when properly guided, it still lacks the consistency and nuance needed for trusted trade decisions.

Key takeaways:

- It works better with indicator-based strategies, especially if the chart is clean and clearly labelled

- Strategies with fixed rules (e.g. RSI cross, MA break) perform better than those based on discretion

- Adding clear labels to your chart screenshots helps guide the AI’s understanding and analysis

Using AI for Coding Indicators

Use ChatGPT to speed up simple Pine Script tasks like prototyping indicators or tweaking logic — just be ready for trial and error. It’s a helpful shortcut, but far from foolproof.

Here’s how you should approach the thought process when coding with ChatGPT:

- Start with a Clear Idea

Be clear about what you want to build. AI performs best when you give it a defined task — like coding a moving average crossover or modifying a basic RSI script. Vague prompts often lead to confusion or unusable code.

- Modify and Iterate

Paste in a script and ask for changes. AI can help you make edits, add features, or clean up your code — but expect to go back and forth a few times. The process isn’t instant and sometimes the AI may get stuck repeating the same solution or misinterpreting your request.

- Understand the Drawbacks

AI struggles with more complex or multi-condition scripts, especially when logic becomes nested or time-sensitive. It may produce code that looks syntactically correct but fails when executed. If you’re not able to spot those errors yourself, you’ll need extra patience — or experience — to guide the AI back on track.

- Learn as You Build

Use AI not just to write code, but to explain it. This helps you understand Pine Script and make smarter edits on your own. For beginners, it can act as a tutor — but it’s not a replacement for learning the coding language if you want full control.

AI isn’t a perfect coder, but it’s a solid assistant — especially for simplifying basic ideas or helping non-coders bring rough ideas to life with enough back-and-forth.

Wrap-Up and Takeaways

AI won’t tell you what to trade. It won’t turn you into a profitable trader overnight. But it will help you:

| Track your performance more intelligently |

| Refine your process and execution |

| Stay accountable to your own rules |

The traders who win in this next era won’t be the ones who fully automate — they’ll be the ones who use AI to think sharper, act smarter, and trade with clarity.