Prop Firm Trader Qualities: What Makes a ‘Good’ Funded Trader?

What separates winning prop traders from those who blow their accounts? It’s not luck—it’s risk control, consistency, discipline, adaptability, and emotional strength.

Proprietary trading—often called prop trading—was once reserved for in-house desks risking the firm’s own capital. Today, funded-trader programs like FXIFY™ give skilled retail traders that same opportunity—provided they first prove they embody the prop firm trader qualities we value most.

At FXIFY, we empower traders with substantial buying power while shielding their personal funds. In return, we seek partners who trade with discipline, protect capital, and focus on sustainable growth—not gamblers hoping for a lucky spike.

So, what separates a consistently profitable partner from a flash-in-the-pan winner? Skill, structured risk, and a resilient mindset always outrank short-term gains.

1. Profit Generation vs. Capital Protection

You might think huge trading gains impress prop firms like us most—but there’s more to it. We’re far more interested in how you achieve those gains, especially how effectively you manage risk.

A trader scoring a huge gain through excessive, uncontrolled risk often represents a liability. Sure, you might occasionally score big—but is that skill, or just gambling with prop capital? That’s not an edge; it’s unnecessary exposure. And that’s exactly the risk prop firms avoid.

Our foremost priority involves preserving that capital base while seeking steady growth. Therefore, reckless trading introduces unacceptable volatility.

We place far more value on traders who show consistent, responsible risk management over those chasing big wins. Respecting daily and overall drawdown limits isn’t optional—it’s a clear signal of professionalism and a focus on protecting capital.

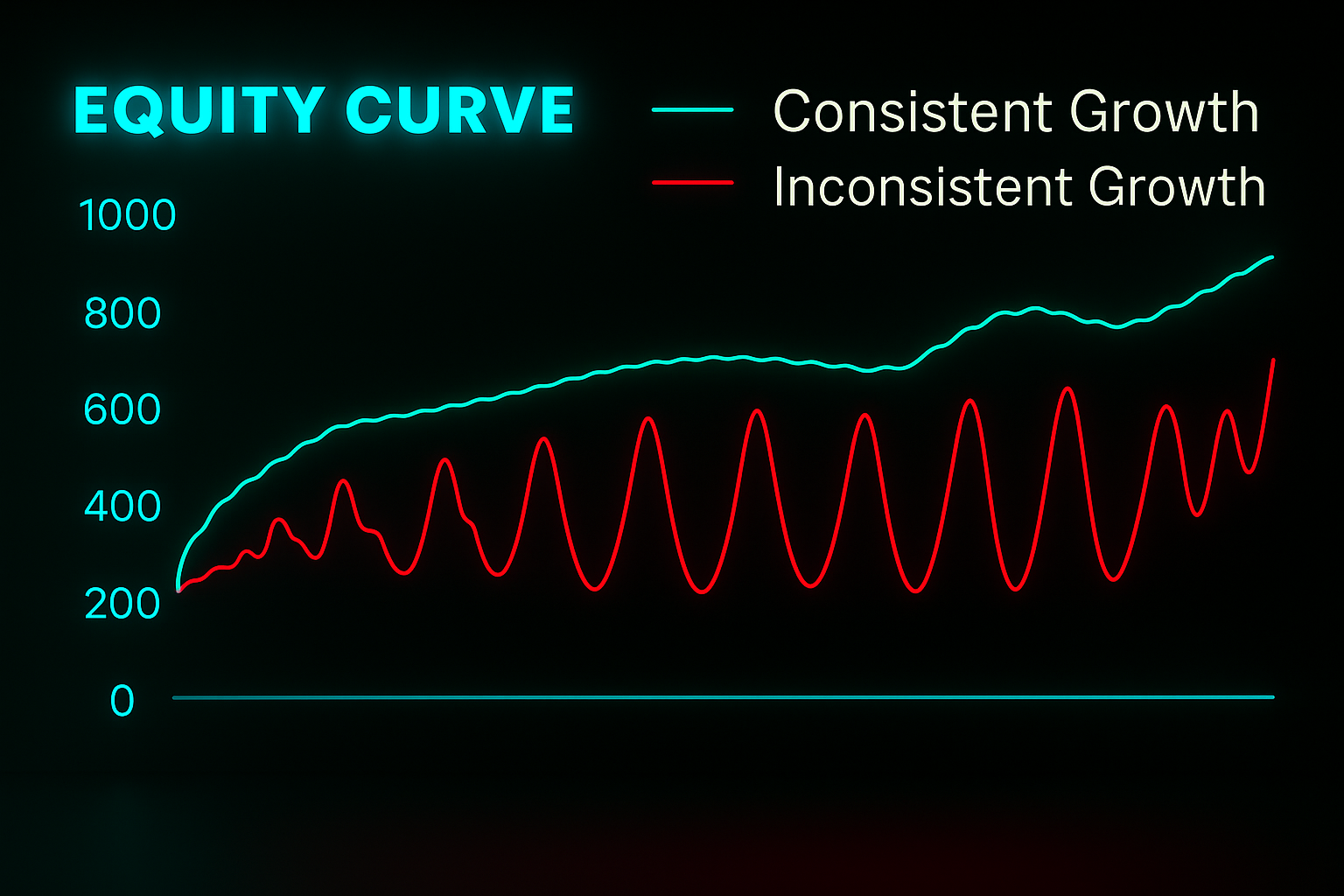

A trader who delivers steady returns while managing risk carefully is a far better long-term partner than one with wild swings and unpredictable equity curves. That consistency builds trust—and trust is everything in prop trading.

2. Consistency Over Luck: A Core Trader Quality

Consider the comparison: one trader consistently earns 2–5% per month while managing risk carefully; another hits 40% one month, then crashes 20% the next. Who would you trust with your capital?

We generally prefer this trader over another who hits 40% in one volatile month. Taking huge risks on news events, for example, might lead to this. But then losing 20% the following month, possibly breaching drawdown limits, shows poor consistency.

The first trader provides evidence of a process and discipline. The second suggests gambling, lacking the desired prop firm trader qualities. While some firms might enforce specific ‘consistency rules,’ the core principle is universal.

Demonstrating a stable, repeatable approach builds confidence. Furthermore, it naturally leads to more predictable performance. This aligns perfectly with sustainable capital growth and prudent risk management – essential prop firm trader qualities we highly value.

3. Disciplined Risk Management: The Most Critical Prop Firm Trader Quality

This remains arguably the most crucial characteristic we assess. When we provide capital, your ability to manage the inherent risk is paramount. Good traders don’t just understand concepts; they implement them rigorously. Key techniques revealing positive prop firm trader qualities include:

- Position Sizing: This isn’t guessing; it involves calculating the precise capital percentage to risk per trade (e.g., 0.5-1%). Proper sizing ensures that even a string of losses doesn’t critically endanger the account. Failing here means one bad trade can wipe out weeks of gains.

- Leverage Control: Leverage magnifies both profits and losses. Disciplined traders use it judiciously, fully understanding its power and danger. They consequently avoid excessive leverage that increases volatility and risk. Understanding what leverage is in trading is fundamental. Indeed, misusing it is a fast path to account failure.

- Stop-Loss Orders: Every trade should have a predetermined exit point. This limits losses if the market moves adversely. Using stop-losses consistently is a non-negotiable aspect of professional trading. Neglecting them turns manageable risks into potentially catastrophic ones, revealing poor prop firm trader qualities.

Our risk rules, especially daily and overall drawdown limits, act as guardrails. They exist to encourage disciplined trading and protect the integrity of the account. Repeatedly breaching these limits reflects a lack of control, regardless of the account’s overall performance.

Such breaches typically lead to losing the funded account. This happens because the trader couldn’t operate within acceptable parameters. Knowing the specifics of different types of drawdowns and how they’re measured is vital.

Let’s revisit the scenario: A trader nets $2,000 profit. Emboldened, they enter an oversized position without a stop-loss. Then, the market reverses sharply.

Their open position tanks and blows past the daily drawdown limit. Sure, the account might still show an overall profit—but the rules were broken. One oversized trade just put the whole account at risk.

4. Adaptability & Strategy Refinement: Evolving Trader Qualities

Financial markets are not static; instead, they are constantly evolving ecosystems. Volatility changes, new patterns emerge, and economic shifts alter dynamics. Therefore, prop firm trader qualities must include adaptability.

A strategy performing exceptionally well last year might struggle today. Consequently, we highly value traders who demonstrate adaptability. A good trader understands no single strategy works perfectly forever.

How can one cultivate adaptability effectively?

- Regular Backtesting: When you understand your tools and how they’ve performed in the past, it becomes easier to spot what works—and what doesn’t—across different market conditions.

- Meticulous Trade Journaling: Recording rationale, market context, emotions, and outcomes—not just entries/exits—helps with objective assessment of your performance

- Insightful Performance Analysis: Reviewing your journal and metrics helps spot recurring errors, identify strategy decay, and pinpoint areas needing adjustment—key for ongoing adaptability.

Being adaptable doesn’t mean constantly switching strategies. Indeed, ‘system hopping’ is often counterproductive. True adaptability involves making informed, data-driven adjustments. This keeps an existing approach aligned with current market behaviour, a key aspect of strong prop firm trader qualities.

Supporting tools like Expert Advisors (EAs), which we often permit*, can help automate tested strategies. Consequently, this frees up mental capital for higher-level analysis and strategic refinement.

*Be sure to review our Terms & Conditions for detailed guidance on the use of Expert Advisors (EAs).

5. Strong Emotional Control: Foundational Prop Firm Trader Qualities

Trading is inherently psychological. The potential for profit and loss triggers powerful emotions: fear, greed, hope, and frustration. While natural, allowing these to dictate decisions is a common path to failure. Thus, strong emotional control is among the vital qualities of a prop firm trader.

We actively look for traders exhibiting robust emotional discipline. This involves mastering several key challenges:

- Revenge Trading: That urge to jump back in right after a loss? It’s usually a fast track to bigger, messier trades. Trying to “make it back” rarely ends well.

- Emotional Frustration: When anger or stress starts creeping in after a tough session, the smart move is to pause. Step away, cool off—don’t let emotions drive your next trade.

- Overconfidence: Winning streaks can trick you into thinking you’re invincible. Stay grounded, stick to your plan, and don’t let success lead to reckless decisions.

- FOMO (Fear of Missing Out): Jumping into fast-moving markets just because “something’s happening” is rarely a good idea. These trades are often rushed, late, and high-risk.

Practical steps are essential for building emotional resilience: Firstly, set firm loss limits and stop when hit. Secondly, create and follow a detailed trading plan. Thirdly, take scheduled breaks, especially after emotional trades. Finally, use stress-reduction techniques.

Emotional stability underpins consistent execution and adherence to risk rules. Furthermore, this stability is vital within the structured environment of a funded account. It’s one of the most fundamental prop firm trader qualities.

6. Leaving a Buffer in Your Account When Withdrawing Payouts

And here’s the golden nugget: The best prop traders always leave a buffer when withdrawing profits. This small habit can make all the difference.

A buffer simply means keeping a portion of your profits inside the account, instead of withdrawing everything. It acts as a safety cushion that gives you breathing room when trading.

Why is this good practice? Because it keeps your account healthy and growing. With a larger balance, you’re better positioned to scale up your trades over time, handle volatility, and keep a consistent rhythm without stressing over every pip.

If you’re withdrawing right down to the limit, you’re leaving no room for error — and that’s already a red flag in your risk management.

This is how successful prop traders stay in the game for the long haul.

What Makes a ‘Bad’ Trader in Prop Firms’ Eyes: Lacking Key Qualities

Conversely, certain behaviours consistently signal a poor fit. They often lead to evaluation failure or loss of funding because they demonstrate a lack of essential prop firm trader qualities:

- Traders who breach rules repeatedly, or try to game the system: Our rules exist fundamentally to manage risk. Repeated breaches show a critical lack of discipline and respect for capital. Also, trying to find loopholes reveals an unsustainable approach.

- Inconsistent performance with high risk: As discussed, wild swings between large profits and losses are unsustainable. This high volatility points to poor strategy or risk management, and a lack of good prop firm trader qualities. It makes future performance unpredictable.

- Treating challenges like a lottery ticket: Approaching evaluations as a gamble ignores the need for skill. Using maximum risk hoping for luck is misaligned with professional trading and desired prop firm trader qualities.

- Ignoring trading psychology: Failing to manage emotions leads to poor decisions under pressure. Succumbing to fear or greed leads to rule breaches. This psychological aspect is a major factor in why most traders fail.

Conclusion: Cultivating Winning Prop Firm Trader Qualities

Ultimately, becoming a successful trader valued by a proprietary trading firm involves far more than simply chasing profits. It requires embodying a professional ethos grounded in discipline and responsibility. These are the core prop firm trader Qualities we seek.

The relationship functions as a partnership built on trust and a long-term perspective. Here are the qualities you should strive for as a prop trader:

Disciplined Risk Management: Protecting capital by sticking to clear rules around drawdowns, position sizing, and leverage.

Consistent Performance: Delivering steady, repeatable results instead of swinging between big wins and losses.

Adaptability: Refining your strategy as markets evolve—without constantly jumping from one system to another.

Emotional Control: Making calm, rational decisions even when trades don’t go your way.

By actively cultivating these attributes, traders enhance their chances significantly. They improve prospects for passing evaluations, securing funding, and building a sustainable trading career. Possessing these prop firm trader qualities is crucial.

Understanding a firm’s specific program rules and objectives, such as those offered by FXIFY™, can further help. It assists in aligning your trading approach with the prop firm trader qualities essential for success in the funded trading space.